[TA-Lib] #1 Exploring the Essentials of Technical Analysis and TA-Lib

- CloneCoding

- Searies / TA-Lib

- August 10, 2023

In the realm of financial market analysis and investment strategy formulation, technical analysis plays a pivotal role. This series aims to provide a profound understanding of the essence and applications of technical analysis, along with insights into TA-Lib, a key tool used in this domain. For the inaugural piece of this series, we shall delve into the theories and applications of technical analysis and elucidate the definition and structure of TA-Lib.

This series will benefit investors, programmers, and all those interested in financial analysis, concentrating on enhancing the ability to comprehend and utilize an objective and scientific approach to investing through technical analysis.

Theories and Applications of Technical Analysis

Definition and Background

Technical analysis is the scientific study of price movements and trading volume flows in the financial markets, utilizing mathematical and statistical methods. It represents an endeavor to forecast future market trends based on historical data and is considered one of the scientific approaches to investment.

Key Assumptions

Technical analysis is underpinned by several crucial assumptions:

- Market Efficiency: All pertinent information is already reflected in the prices.

- Price Trending: Prices move in discernible trends.

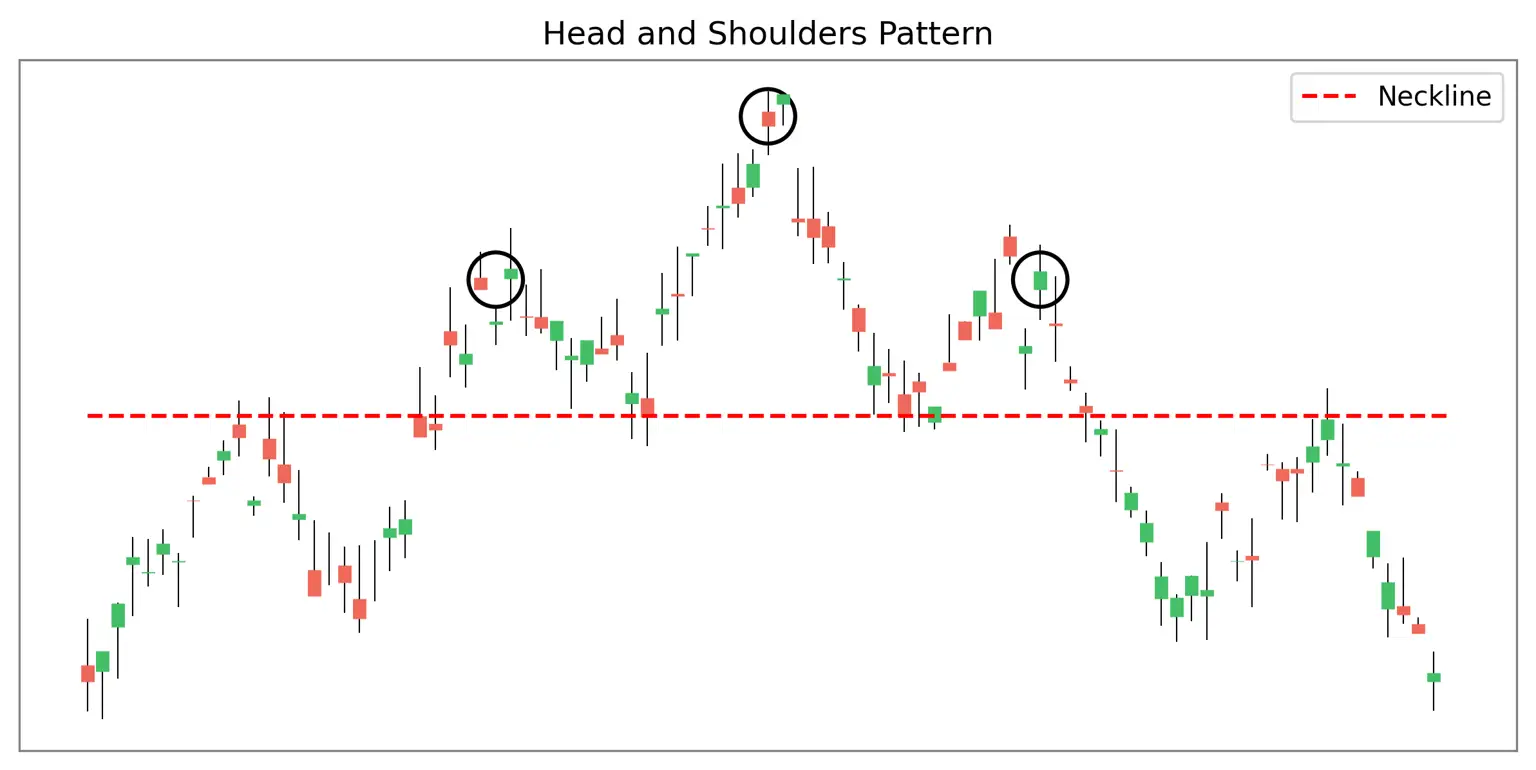

- Historical Repetition: Specific patterns and formations recur in both the past and the future.

TA-Lib: The Core Tool of Technical Analysis

TA-Lib, or Technical Analysis Library, is a globally renowned programming library for technical analysis. Designed to facilitate effective execution of technical analysis, it has secured its place as one of the most trusted tools in the financial industry. TA-Lib's significance transcends mere coding functionality, being regarded as an essential component of modern financial analysis.

Definition and Structure of TA-Lib

Functions and Components

TA-Lib simplifies and standardizes complex tasks such as technical indicator calculation, pattern recognition, and time series analysis. Here are the principal elements of its structure:

- Indicator Calculation: Offers over 150 technical indicators, enabling various quantitative analyses such as moving averages, MACD, RSI, etc.

- Pattern Recognition: Analyzes past price and volume data to recognize patterns that have recurred in the past, thereby predicting future market behavior.

- Time Series Analysis: Studies the sequence and pattern of data over time, discerning components like trends and seasonality.

Platforms and Languages

TA-Lib seamlessly integrates with various programming languages like C, C++, Java, Python, thereby allowing developers to operate within their preferred language and environment.

Community and Open Source Philosophy

TA-Lib operates as an open-source project, collaboratively developed and maintained by developers worldwide. This leads to continuous updates and improvements, granting users the flexibility to use or modify the code as needed.

Application Fields

Financial institutions, investment banks, algorithmic trading firms, individual investors, and many other entities utilize TA-Lib for analyzing various financial products such as stocks, futures, foreign exchange, etc.

TA-Lib acts as a potent tool that simplifies and standardizes the complexities of technical analysis, enabling market analysis in a standardized fashion. Its multifaceted functionality and open-source philosophy have broadened its use, making it an indispensable element of contemporary financial analysis. Technical analysis is widely utilized as a scientific method of market analysis, with TA-Lib at its core, enhancing the capability for an objective and scientific approach to investment.

FAQs

- What programming language is TA-Lib written in? TA-Lib is written in C and offers wrappers for compatibility with various languages.

- Can individual investors use TA-Lib? Yes, TA-Lib is an open-source project and is freely available for download and use.

- What technical background is required to learn TA-Lib? A foundational understanding of programming and the financial markets is sufficient to effectively utilize TA-Lib.

- What financial products can TA-Lib be applied to? TA-Lib can be used to analyze a diverse range of financial products, including stocks, futures, foreign exchange, bonds, etc.

- How can one participate in the TA-Lib community? One can engage with the TA-Lib community and contribute to development and troubleshooting through the official TA-Lib website and GitHub page.

Other Posts in the Searies / TA-Lib

CloneCoding

Innovation Starts with a Single Line of Code!

Categories

- Language(47)

- Web(19)

- Searies(7)

- Tips & Tutorial(4)

Recent Posts

![[JavaScript] Downloading Screenshots using html2canvas]() Learn how to download webpage screenshots using the html2canvas library. Dive into its features, advantages, installation, usage, and things to watch out for.

Learn how to download webpage screenshots using the html2canvas library. Dive into its features, advantages, installation, usage, and things to watch out for.![[CSS] Dark Mode Guide: System & User-Based CSS Implementation]() Explore methods to implement dark mode on your webpage. Understand how to use system settings and user choices for effective dark mode transitions.

Explore methods to implement dark mode on your webpage. Understand how to use system settings and user choices for effective dark mode transitions.![[Next.js] When to Use SSR, SSG, and CSR - Ideal Use Cases Explored]() In Next.js, we detail which rendering method, be it SSR, SSG, or CSR, is best suited for different site categories.

In Next.js, we detail which rendering method, be it SSR, SSG, or CSR, is best suited for different site categories.![[CSS] Pseudo Selector Guide - Essential Styling Techniques]() An in-depth look into CSS pseudo selectors. Learn about :first-child, :last-child, :nth-child(n) and more. Discover practical application scenarios.

An in-depth look into CSS pseudo selectors. Learn about :first-child, :last-child, :nth-child(n) and more. Discover practical application scenarios.![[Next.js] SSR vs. CSR vs. SSG: Understanding Web Rendering Techniques]() A deep dive into the three rendering methods in Next.js: Server Side Rendering (SSR), Client Side Rendering (CSR), and Static Site Generation (SSG), exploring their workings, benefits, and drawbacks.

A deep dive into the three rendering methods in Next.js: Server Side Rendering (SSR), Client Side Rendering (CSR), and Static Site Generation (SSG), exploring their workings, benefits, and drawbacks.

![[JavaScript] Downloading Screenshots using html2canvas](https://img.clonecoding.com/thumb/101/16x9/320/javascript-downloading-screenshots-using-html2canvas.webp)

![[CSS] Dark Mode Guide: System & User-Based CSS Implementation](https://img.clonecoding.com/thumb/100/16x9/320/css-dark-mode-guide-system-user-based-css-implementation.webp)

![[Next.js] When to Use SSR, SSG, and CSR - Ideal Use Cases Explored](https://img.clonecoding.com/thumb/99/16x9/320/next-js-when-to-use-ssr-ssg-and-csr-ideal-use-cases-explored.webp)

![[CSS] Pseudo Selector Guide - Essential Styling Techniques](https://img.clonecoding.com/thumb/98/16x9/320/css-pseudo-selector-guide-essential-styling-techniques.webp)

![[Next.js] SSR vs. CSR vs. SSG: Understanding Web Rendering Techniques](https://img.clonecoding.com/thumb/97/16x9/320/next-js-ssr-vs-csr-vs-ssg-understanding-web-rendering-techniques.webp)