[TA-Lib] #4: Moving Average Analysis - Golden & Dead Cross

- CloneCoding

- Searies / TA-Lib

- August 16, 2023

Implementation of Moving Averages with TA-Lib

TA-Lib serves as an essential instrument for financial market analysis, assisting in the computation of various indicators. For an introduction to TA-Lib, please refer to [TA-Lib] #1 Exploring the Essentials of Technical Analysis and TA-Lib, and for installation instructions, consult [TA-Lib] #2: Installing TA-Lib for Technical Analysis. Guidance on how to retrieve price data using yahooquery can be found at [Python] Yahooquery: Retrieving and Managing Past Stock and Financial Data.

Calculation of Moving Averages and Code Sample

from yahooquery import Ticker

import talib

import pandas as pd

# Retrieve Google stock data

google = Ticker("GOOG")

price_data = google.history(period="2y")

close_prices = price_data['close'].values

# Compute Simple Moving Average

sma = talib.SMA(close_prices, timeperiod=20)

# Compute Exponential Moving Average

ema = talib.EMA(close_prices, timeperiod=20)

# Compute Weighted Moving Average

wma = talib.WMA(close_prices, timeperiod=20)

# Display Results

result = pd.DataFrame({

'Close Prices': close_prices,

'SMA': sma,

'EMA': ema,

'WMA': wma

})

print(result.tail()) Close Prices SMA EMA WMA

498 130.149994 127.218999 127.709403 128.844237

499 130.210007 127.487999 127.947556 129.129094

500 130.169998 127.711499 128.159217 129.384523

501 131.830002 128.049999 128.508816 129.776761

502 130.270004 128.359499 128.676548 129.988190Market Trend Analysis Using TA-Lib

Utilizing moving averages enables the analysis of the overall trend of the market.

last_5_sma = sma[-5:]

# Ascending Trend Confirmation

if all(last_5_sma[i] < last_5_sma[i + 1] for i in range(4)):

print("The market is in an upward trend.")

# Descending Trend Confirmation

elif all(last_5_sma[i] > last_5_sma[i + 1] for i in range(4)):

print("The market is in a downward trend.")

else:

print("The market is stable.")In this example, the market trend over the last 5 days is analyzed using moving averages. The trend is classified as ascending if the moving averages increase consecutively, and descending if they decrease.

sma5 = talib.SMA(close_prices, timeperiod=5)

sma20 = talib.SMA(close_prices, timeperiod=20)

sma60 = talib.SMA(close_prices, timeperiod=60)

# Assumption: Short-term, Mid-term, Long-term moving averages for the last 5 days

short_ma_last_5 = sma5[-5:]

mid_ma_last_5 = sma20[-5:]

long_ma_last_5 = sma60[-5:]

# Confirmation of Each Moving Average Rising Consecutively

is_short_ma_rising = all(x < y for x, y in zip(short_ma_last_5, short_ma_last_5[1:]))

is_mid_ma_rising = all(x < y for x, y in zip(mid_ma_last_5, mid_ma_last_5[1:]))

is_long_ma_rising = all(x < y for x, y in zip(long_ma_last_5, long_ma_last_5[1:]))

# Trend Analysis

if is_short_ma_rising and is_mid_ma_rising and is_long_ma_rising:

print("Strong upward trend")

elif is_short_ma_rising:

print("Short-term upward trend")

elif is_long_ma_rising:

print("Long-term upward trend")

else:

print("The trend is ambiguous")This example compares the short-term, mid-term, and long-term moving averages for the last 5 days to analyze the market trend.

- By confirming whether each moving average is consecutively rising, an upward trend is identified. If short-term, mid-term, and long-term moving averages are all rising, it is considered a strong upward trend; if only the short-term is rising, it is a short-term upward trend; if only the long-term is rising, it is a long-term upward trend.

- In the case of a downward trend, a trend is determined if each moving average is consecutively declining. Depending on which of the short-term, mid-term, long-term moving averages is declining, the trend can be further categorized.

- If the trend is unclear, i.e., only some of the short-term, mid-term, long-term moving averages are rising or declining, further analysis may be required.

This method offers the advantage of understanding the overall market situation by considering the changes in each moving average, and precisely analyzing and segmenting the rising and falling trends. Different periods and moving average indicators can be used for more refined analysis, allowing for flexible application in investment strategies.

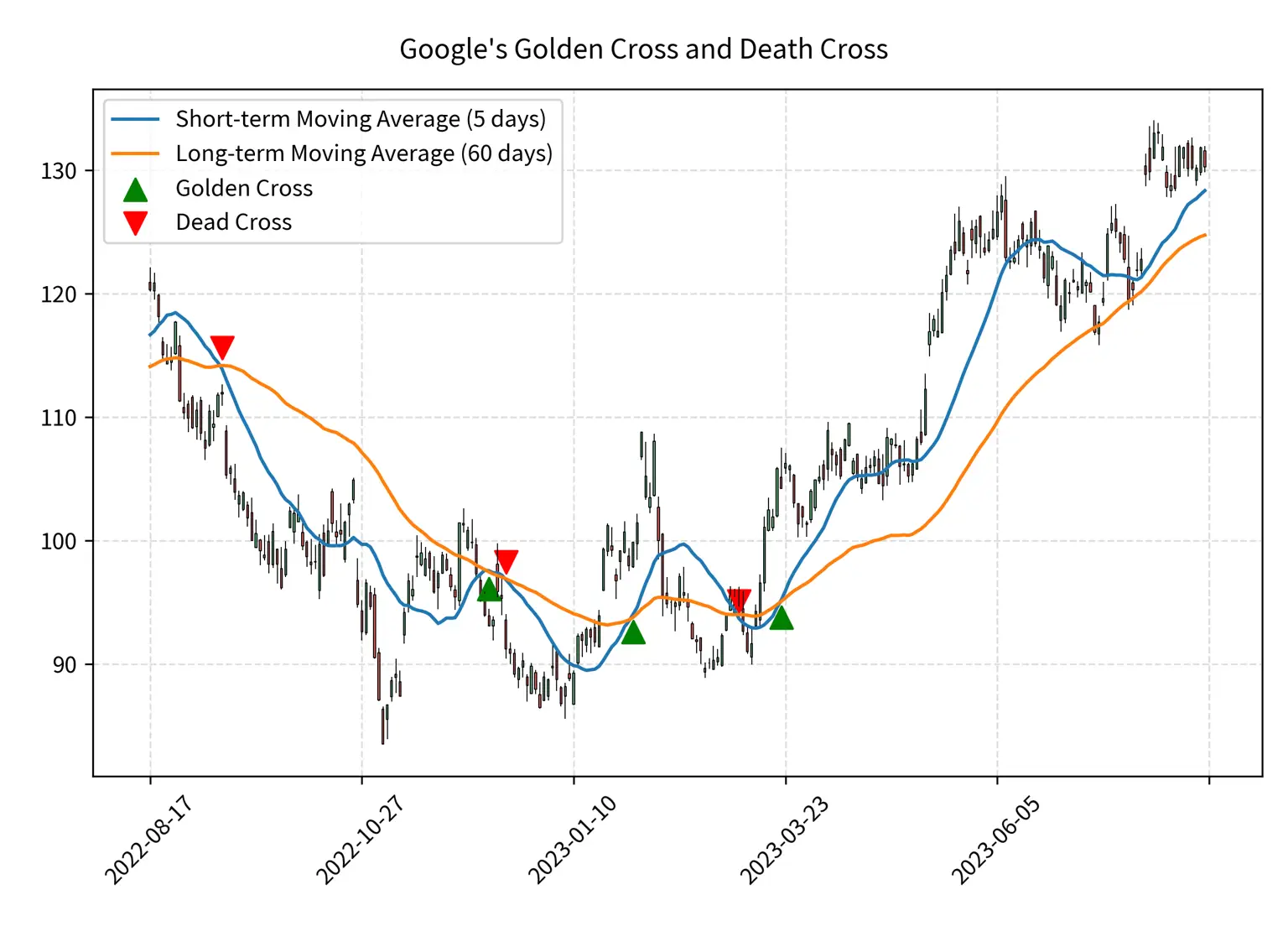

Analysis of Golden Cross and Dead Cross Using TA-Lib

Golden Cross

A golden cross occurs when the short-term moving average breaks above the long-term moving average. The following code demonstrates how to find a golden cross.

short_sma = talib.SMA(close_prices, timeperiod=20)

long_sma = talib.SMA(close_prices, timeperiod=60)

# Finding a golden cross

for i in range(1, len(close_prices)):

if short_sma[i] > long_sma[i] and short_sma[i-1] <= long_sma[i-1]:

print(f"Golden cross identified: day {i}")Dead Cross

A dead cross occurs when the short-term moving average breaks below the long-term moving average. The following code is an example of how to find a dead cross.

# Finding a dead cross

for i in range(1, len(close_prices)):

if short_sma[i] < long_sma[i] and short_sma[i-1] >= long_sma[i-1]:

print(f"Dead cross identified: day {i}")Market analysis utilizing moving averages and TA-Lib can provide crucial information to investors. From simple moving averages to complex indicators such as the golden cross and dead cross, various methods can analyze market trends and shifts. This insight helps in planning and executing investment strategies more precisely and in comprehending subtle market movements.

FAQs

- How can I install TA-Lib?

- Various methods are available for installing TA-Lib, and detailed instructions can be found at [TA-Lib] #2: Installing TA-Lib for Technical Analysis.

- What other indicators can I calculate using TA-Lib besides moving averages?

- TA-Lib offers over 150 technical indicators, including Bollinger Bands, RSI, MACD, etc. Stay tuned to this series as we plan to cover these other indicators in detail.

- How can I know when a golden cross or dead cross occurs?

- Golden and dead crosses occur when short-term moving averages break above or below long-term moving averages, respectively. You can identify these signals by using the code examples provided.

- What other technical indicators might be useful for novice investors?

- For novice investors, indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands may be valuable. These measures gauge price relative strength and volatility, so using them alongside moving averages can aid in analyzing various facets of the market.

- Are there limitations to using only moving average line analysis? How should it be combined with other analytical methods?

- While moving average lines are useful in discerning general market trends, they may have limitations in analyzing complex market situations or specific events. It is advisable to complement them with fundamental analysis, other technical indicators, economic indicators, etc., to create a comprehensive investment strategy. Combining various analytical methods allows for a more accurate understanding and prediction of the multifaceted aspects of the market.

Other Posts in the Searies / TA-Lib

CloneCoding

Innovation Starts with a Single Line of Code!

Categories

- Language(47)

- Web(19)

- Searies(7)

- Tips & Tutorial(4)

Recent Posts

![[JavaScript] Downloading Screenshots using html2canvas]() Learn how to download webpage screenshots using the html2canvas library. Dive into its features, advantages, installation, usage, and things to watch out for.

Learn how to download webpage screenshots using the html2canvas library. Dive into its features, advantages, installation, usage, and things to watch out for.![[CSS] Dark Mode Guide: System & User-Based CSS Implementation]() Explore methods to implement dark mode on your webpage. Understand how to use system settings and user choices for effective dark mode transitions.

Explore methods to implement dark mode on your webpage. Understand how to use system settings and user choices for effective dark mode transitions.![[Next.js] When to Use SSR, SSG, and CSR - Ideal Use Cases Explored]() In Next.js, we detail which rendering method, be it SSR, SSG, or CSR, is best suited for different site categories.

In Next.js, we detail which rendering method, be it SSR, SSG, or CSR, is best suited for different site categories.![[CSS] Pseudo Selector Guide - Essential Styling Techniques]() An in-depth look into CSS pseudo selectors. Learn about :first-child, :last-child, :nth-child(n) and more. Discover practical application scenarios.

An in-depth look into CSS pseudo selectors. Learn about :first-child, :last-child, :nth-child(n) and more. Discover practical application scenarios.![[Next.js] SSR vs. CSR vs. SSG: Understanding Web Rendering Techniques]() A deep dive into the three rendering methods in Next.js: Server Side Rendering (SSR), Client Side Rendering (CSR), and Static Site Generation (SSG), exploring their workings, benefits, and drawbacks.

A deep dive into the three rendering methods in Next.js: Server Side Rendering (SSR), Client Side Rendering (CSR), and Static Site Generation (SSG), exploring their workings, benefits, and drawbacks.

![[JavaScript] Downloading Screenshots using html2canvas](https://img.clonecoding.com/thumb/101/16x9/320/javascript-downloading-screenshots-using-html2canvas.webp)

![[CSS] Dark Mode Guide: System & User-Based CSS Implementation](https://img.clonecoding.com/thumb/100/16x9/320/css-dark-mode-guide-system-user-based-css-implementation.webp)

![[Next.js] When to Use SSR, SSG, and CSR - Ideal Use Cases Explored](https://img.clonecoding.com/thumb/99/16x9/320/next-js-when-to-use-ssr-ssg-and-csr-ideal-use-cases-explored.webp)

![[CSS] Pseudo Selector Guide - Essential Styling Techniques](https://img.clonecoding.com/thumb/98/16x9/320/css-pseudo-selector-guide-essential-styling-techniques.webp)

![[Next.js] SSR vs. CSR vs. SSG: Understanding Web Rendering Techniques](https://img.clonecoding.com/thumb/97/16x9/320/next-js-ssr-vs-csr-vs-ssg-understanding-web-rendering-techniques.webp)